Bionano Genomics (NASDAQ: BNGO) share worth is down 55% from a yr in the past. | Zoom Fintech

Taking the occasional loss is half the worth of investing within the inventory market. And sadly for Bionano Genomics, Inc. (NASDAQ: BNGO) shareholders, the inventory is just about down proper now than it was 12 months previously. The share worth is down 55% on this level. We would not be speeding to move judgment on Bionano Genomics as a result of we do not have a protracted historical past to have a look at. The silver lining is that the inventory is up 2.6% in a matter of weeks.

See our newest overview for Bionano Genomics

Because of the lack of Bionano Genomics over the previous twelve months, we anticipate the market to focus extra on income and income improvement, at least in the mean time. Sometimes, companies with no earnings are anticipated to develop earnings every year, and at an excellent price. It is because it’s costly to make sure that a corporation will likely be sustainable if the income improvement is negligible and it doesn’t generate any income in any method.

Bionano Genomics’ revenues haven’t modified in any method over the previous 12 months. Actually, it has fallen 36%. It appears to be like fairly darkish, at a look. Within the absence of earnings, it isn’t unreasonable that the share worth has fallen 55%. That stated, if improvement comes ultimately, the inventory might have longer days to return. We typically do not desire private corporations with declining revenues and no revenues, so we’re fairly cautious about this one within the meantime.

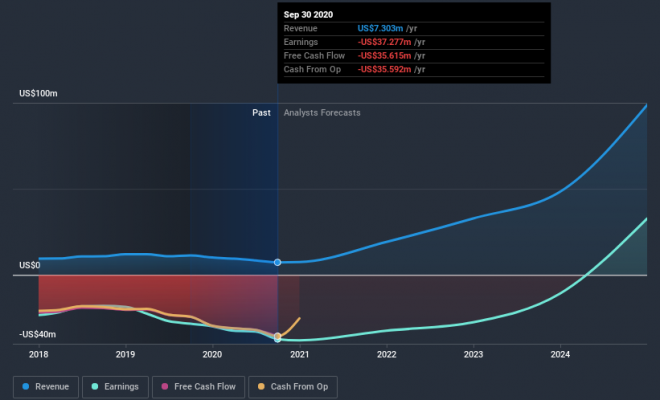

Under you’ll be able to see how income and earnings have developed over time (try the precise values by clicking on the picture).

The facility of the soundness sheet is important. It is perhaps value watching our free report on how its financial place has modified over time

A totally completely different perspective

Offered the market has gained 25% previously 12 months, Bionano Genomics shareholders is perhaps upset that they misplaced 55%. Whereas the aim is to do greater than that, it is value remembering that even good long-term investments sometimes underperform for 12 months or extra. The decline within the share worth has continued all through the previous three months, down 4.4%, suggesting an absence of enthusiasm on the a part of merchants. Given the comparatively fast historic previous of this inventory, we’d stay pretty cautious till we see sturdy company effectivity. Whereas it’s positively value contemplating the utterly completely different impacts that market conditions can have on the share worth, there are completely different components which can be rather more important. Even so, do not forget that Bionano Genomics displays 5 warning indicators in our funding evaluation , and a few of them concern …

Should you’d moderately check out one other enterprise – one with probably superior funds – then do not miss this free listing of corporations which have confirmed that they are going to develop earnings.

Please say that the market returns quoted on this article replicate the widespread market-weighted returns of shares presently traded on the US inventory exchanges.

Promoted

When shopping for and promoting Bionano Genomics or another financing, use the platform that many see as the abilities gateway to the worldwide market, interactive brokers. You get the bottom value * of shopping for and promoting shares, shares, futures, currencies, bonds and funds worldwide from one built-in account.

This textual content from Merely Wall St is fundamental in nature. It doesn’t symbolize recommendation to purchase or promote shares, and doesn’t have in mind your objectives or your financial scenario. Our aim is to hold out a long-term targeted evaluation for you, pushed by fundamental data. Be aware that our evaluation might not be printed within the newest worth delicate firm newsletters or in qualitative papers. Solely Wall St has no place within the actions we’re speaking about.

*Interactive Brokers Ranked Lowest Value Dealer by StockBrokers.com On-line Annual Overview 2020

Do you’ve got any options on this textual content? Concerned regarding the content material of the fabric? Get in contact with us immediately. It’s also possible to ship an e mail to [email protected]

Supply hyperlink